The stock market is a dynamic and intricate financial ecosystem that has inherent dangers in addition to the possibility of large profits. Knowing the basics of the stock market is crucial for making wise decisions and gradually accumulating wealth, regardless of experience level or desire to dabble in the world of stocks. We'll go over all you need to know about the stock market in this in-depth book, from its fundamental ideas to sophisticated success tactics.

Despite its reputation as a scary and complicated beast, the stock market can be an effective tool for gradually increasing wealth. But entering this field for the first time can seem intimidating. This thorough guide acts as your road map, giving you the skills and information you need to confidently negotiate the stock market.

Understanding the Basics

What is the Stock Market?

Investors purchase and sell shares of publicly traded corporations on the stock market, sometimes referred to as the equity market. It is a decentralised marketplace. It provides a venue for businesses to generate money through the issuance of stocks and for investors to get involved in the ownership and expansion of those businesses.

How Does the Stock Market Work?

Stock exchanges, like the New York Stock trading (NYSE) and the Nasdaq, are venues for the trading of stocks between buyers and sellers. The dynamics of supply and demand drive stock prices, and market movements are influenced by a number of factors including investor sentiment, company performance, and economic conditions.

Getting Started in the Stock Market

Setting Investment Goals

Establishing your investing objectives and risk tolerance is crucial before you enter the stock market. Do you invest for short-term gains, asset preservation, or retirement? Your asset allocation and investing approach will be shaped in part by your understanding of your goals.

Building a Diversified Portfolio

Diversification is a key principle of investing that involves spreading your investment across different asset classes, sectors, and geographic regions. By diversifying your portfolio, you can reduce the risk of significant losses and potentially improve your risk-adjusted returns.

Choosing Stocks to Invest In

When selecting stocks to invest in, consider factors such as company fundamentals, industry trends, and valuation metrics. Conduct thorough research and analysis to identify companies with strong growth prospects, competitive advantages, and solid financials.

Advanced Strategies for Success

Technical Analysis

Using historical price and volume data, technical analysis is a technique for examining market trends and stock prices. It entails utilising technical indicators and charts to spot trends and indications that could portend future changes in price.

Fundamental Analysis

Evaluating a company's financial standing, management team, industry standing, and growth prospects are the main goals of fundamental research. Investors can determine a stock's intrinsic worth and make wise investment selections by looking at things like earnings, revenue, debt levels, and competitive advantages.

Risk Management

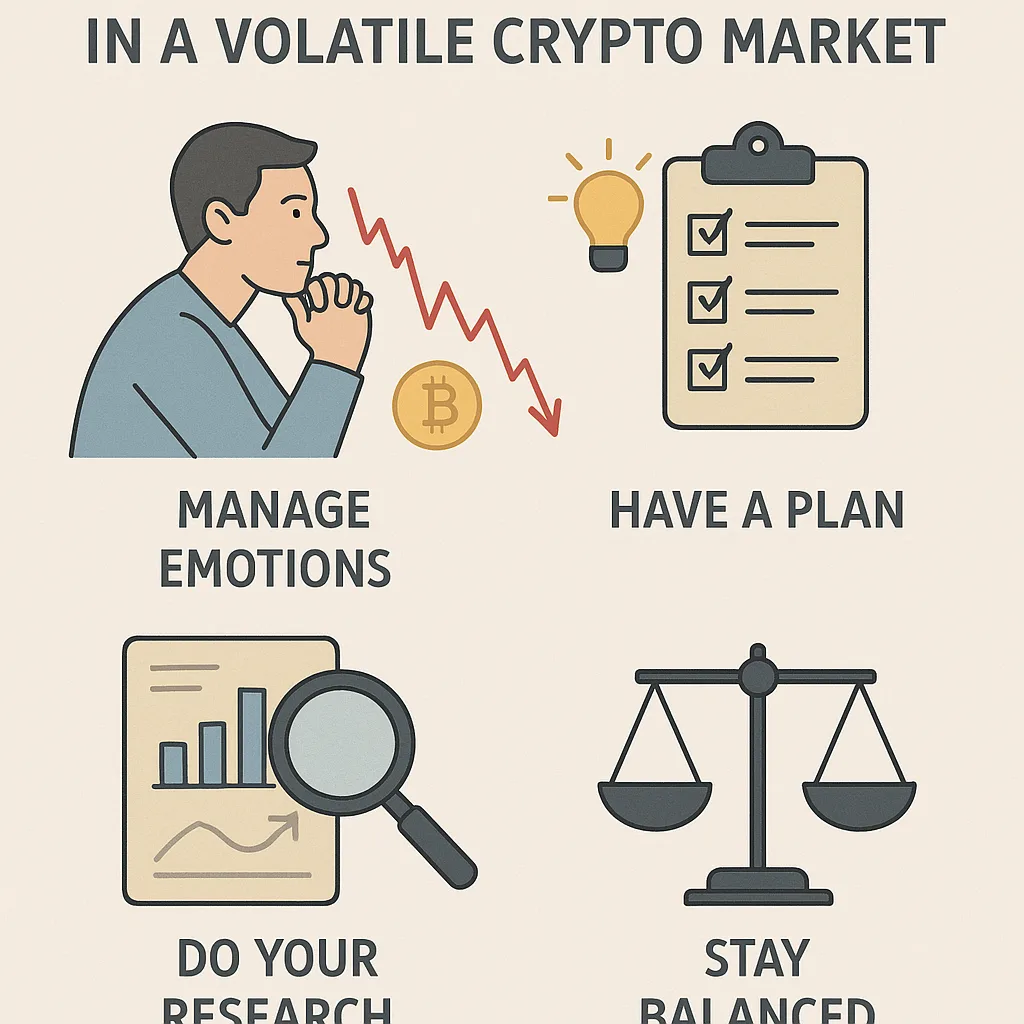

A key component of profitable investing is risk management, which is putting methods in place to reduce possible losses. Stop-loss orders, position sizing, portfolio diversification, and other strategies can help safeguard your money and reduce negative risk.

Tips for New Investors

Start Small and Learn

It's crucial for first-time investors to start modest and progressively increase their investment expertise over time. For a straightforward and diversified approach to obtain stock market exposure, think about investing in inexpensive index funds or exchange-traded funds (ETFs).

Stay Informed and Stay Calm

Prices on the stock market can change dramatically on a daily basis due to a variety of causes. In addition to keeping an eye on market developments, it's critical to keep a long-term perspective and refrain from acting rashly in response to transient swings.

Seek Professional Advice if Needed

If you're uncertain about how to navigate the stock market or manage your investments, consider seeking advice from a financial advisor or investment professional. A professional can help you develop a personalized investment strategy tailored to your goals and risk tolerance.

Investing Strategies for Beginners: Building a Solid Foundation

-

Set Clear Investment Goals: Are you saving for retirement, a down payment on a house, or a short-term goal? Define your goals to determine your investment timeframe and risk tolerance.

-

Do Your Research: Before investing in any stock, research the company's fundamentals (financials, products, competition) and its future outlook.

-

Diversify Your Portfolio: Don't put all your eggs in one basket! Spread your investments across different sectors and asset classes (stocks, bonds, mutual funds) to mitigate risk.

Think of your portfolio as a delicious meal. Don't just have pizza (stocks) every day! Add some veggies (bonds) and a side dish (mutual funds) for a balanced and healthy diet.

Essential Considerations for Beginners: Minimizing Risk and Maximizing Gains

-

Start Small and Gradually Increase Investment: Don't jump in headfirst. Begin with a smaller amount you can afford to potentially lose and gradually increase your investment as you gain experience.

-

Invest for the Long Term: The stock market experiences ups and downs. Don't panic and sell your investments during temporary downturns.

-

Beware of Get-Rich-Quick Schemes: If something sounds too good to be true, it probably is. Avoid any investment promising unrealistic returns.

Investing is a marathon, not a sprint. Patience, discipline, and a long-term perspective are key to success.

Learning Resources for Aspiring Investors: Equipping Yourself for the Road Ahead

-

Online Courses and Tutorials: Several platforms offer free and paid courses on investing basics and strategies.

-

Financial Websites and News Sources: Stay informed about market trends and company news by following reputable financial publications.

-

Investment Books and Articles: Numerous resources provide valuable insights and investment advice.

Conclusion

Through the stock market, investors can take part in the expansion and success of businesses and economies all over the world. Investors can accumulate wealth and meet their financial goals over time by learning the fundamentals of the stock market, establishing specific goals for their investments, and putting good investment techniques into practice. Patience, dedication, and education are the keys to success in the stock market, regardless of experience level.

Leave a Reply